Recurring FedNow® autopay

TodayPayments.com empowers modern businesses to automate recurring billing through FedNow® AutoPay and RTP® "debit" solutions—delivering real-time, irrevocable funds with one-time standing approval. We simplify the payment lifecycle from request to settlement with ISO 20022 data, instant clearing, and fintech-powered reconciliation.

To transform how U.S. businesses manage recurring payments by providing seamless, secure, and instant transaction processing through FedNow® AutoPay, enabling merchants to scale revenue with zero lag, zero chargebacks, and full automation.

Using Incentivizing recurring FedNow® autopay

Incentivizing recurring FedNow® autopay

and recurring Real-Time instant payments, are defined simply as:

Irrevocably collected funds in a Payee bank account and usable

immediately by the owner of the account. An

upfront on-time 'standing approval' using Incentivizing recurring

FedNow® autopay is an instruction or set of

instructions a Payer uses to pre-authorize their financial

institution to pay future Request for Payments, RfPs without

requiring the Payer to review and approve each RfP.

Incentivizing recurring FedNow® autopay

and recurring Real-Time instant payments, are defined simply as:

Irrevocably collected funds in a Payee bank account and usable

immediately by the owner of the account. An

upfront on-time 'standing approval' using Incentivizing recurring

FedNow® autopay is an instruction or set of

instructions a Payer uses to pre-authorize their financial

institution to pay future Request for Payments, RfPs without

requiring the Payer to review and approve each RfP.

Set It and Forget It — FedNow® AutoPay Transforms Recurring Payments

In today’s fast-paced digital economy, businesses can’t afford delays in billing or receivables. Late payments, card declines, and ACH holds drain time and profit. Enter FedNow® AutoPay—the real-time, automated recurring payment system built for the future of business.

With FedNow® and RTP® debit transactions, your business can collect irrevocable funds instantly, directly into your account, backed by standing approvals. Whether it's a C2B utility bill, a B2B service retainer, or a monthly subscription, AutoPay delivers speed, security, and simplicity.

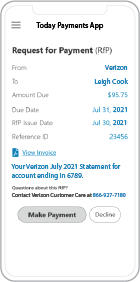

FedNow® AutoPay allows businesses to automatically collect future payments from customers using a one-time standing authorization, which pre-approves the payer’s financial institution to process future Request for Payments (RfPs) on a recurring basis—without manual intervention.

Key Features of FedNow® AutoPay:

- ✅ “Set It and Forget It” Recurring Billing – Payers approve once, then AutoPay handles the rest.

- ✅ Instant Settlement – Irrevocable funds are received and usable immediately.

- ✅ No Chargebacks or ACH Delays – Finality and speed in one platform.

- ✅ Streamlined Cash Flow Forecasting – Real-time visibility into upcoming and settled payments.

- ✅ Supports C2B and B2B Models – Perfect for subscriptions, utilities, insurance, and SaaS.

This modern debit structure gives your business predictable, on-time payments without relying on outdated invoicing, card networks, or approval friction.

Elements of receiving "Automatic Billing Payments" recurring FedNow autopay for your business using instant payments

Recurring RTP® & FedNow® Debit Transactions: How Businesses Automate Collections

FedNow® AutoPay is built on interoperable real-time payment rails, including FedNow® and RTP®, meaning you can reach almost any customer at any participating financial institution nationwide.

How It Works:

- 🎯 The payer provides a one-time standing approval authorizing future debits.

- 🧾 Your business sends an automated Request for Payment (RfP) on a recurring schedule.

- 💰 The funds are transmitted in real-time, instantly clearing into your account.

This solution supports:

- 📂 Uploading billing data via .CSV, .Excel, .XML, or .JSON

- 🔁 ISO 20022-rich data messaging for line-item control and tagging

- ⚙️ Integration with your bank dashboard or fintech automation software

Whether you’re billing monthly, biweekly, or on a custom cycle, AutoPay allows hands-free, real-time reconciliation.

Business Use Cases for FedNow® AutoPay: Reliable, Scalable, and Immediate

AutoPay with FedNow® and RTP® debit is transforming industries that rely on consistent cash flow and reliable payment automation.

Popular Use Cases Include:

- 💼 Professional retainers and managed services billing (B2B)

- 🧾 Utility companies, property management, and insurance (C2B)

- 📦 SaaS platforms and membership sites with recurring subscriptions

- 🎓 Educational institutions with installment billing plans

- 📲 Mobile bill pay apps and digital wallet integrations

Each use case benefits from no card network fees, no delays, and no payer friction. Once approved, payments are collected without interruption—giving your business payment predictability and your customers payment convenience.

Incentivizing recurring FedNow autopay specifically can be a strategic approach to enhance customer retention and streamline payment processes. Here are tailored strategies for both consumers and businesses to promote recurring FedNow autopay:

For Consumers:

- Cashback and Discounts:

- Cashback Programs: Offer a percentage of cashback on every recurring payment made via FedNow autopay.

- Subscription Discounts: Provide discounts on monthly subscriptions (e.g., streaming services, gym memberships) if paid through recurring FedNow autopay.

- Fee Waivers and Rebates:

- Fee Waivers: Waive any setup fees or monthly service fees for setting up recurring payments via FedNow.

- Rebates: Offer a rebate after a certain number of successful recurring payments.

- Enhanced Convenience and Financial Management Tools:

- Budgeting Tools: Provide free access to advanced budgeting and financial management tools for customers who use FedNow autopay.

- Payment Reminders: Offer enhanced notifications and reminders to manage their recurring payments better.

- Loyalty and Rewards Programs:

- Bonus Points: Provide additional loyalty points for each payment made via FedNow autopay, which can be redeemed for rewards.

- Exclusive Offers: Give access to exclusive deals and offers for customers who use recurring FedNow autopay.

- Security and Reliability Assurance:

- Fraud Protection: Emphasize the security features of FedNow, assuring customers that their recurring payments are safe and protected.

- Reliability Guarantee: Offer guarantees on the timely execution of payments, reducing the risk of late fees.

- Educational Initiatives:

- Webinars and Tutorials: Conduct webinars and provide tutorials on setting up and managing recurring payments via FedNow.

- Customer Support: Offer dedicated customer support to assist in setting up and troubleshooting recurring FedNow autopay.

For Businesses:

- Cost Savings:

- Lower Transaction Fees: Offer reduced transaction fees for businesses that receive recurring payments through FedNow.

- Bulk Payment Discounts: Provide discounts for businesses that set up multiple recurring payments through FedNow.

- Cash Flow Benefits:

- Immediate Fund Availability: Promote the advantage of instant fund availability, improving the business’s cash flow management.

- Early Payment Incentives: Offer incentives for businesses that encourage their customers to pay early or on time using recurring FedNow autopay.

- Integration and Support:

- Technical Integration Assistance: Provide free or discounted integration services to help businesses set up FedNow autopay.

- Ongoing Support: Offer dedicated support teams to assist businesses in managing their recurring payment systems.

- Marketing and Co-Branding Opportunities:

- Joint Promotions: Partner with businesses to run joint promotions highlighting the benefits of recurring FedNow autopay.

- Brand Visibility: Enhance the visibility of businesses through co-branded marketing efforts that promote recurring payments via FedNow.

- Operational Efficiency and Risk Management:

- Automated Reconciliation: Offer tools for automated reconciliation of payments, reducing administrative workload.

- Reduced Risk of Fraud: Emphasize the security and lower fraud risk associated with FedNow’s real-time payments.

- Customer Engagement and Satisfaction:

- Feedback Programs: Implement feedback programs to gather insights from businesses about their experiences with FedNow autopay and use this feedback to make improvements.

- Customer Testimonials: Use testimonials and case studies from businesses that have successfully adopted FedNow autopay to encourage others.

Cross-Sector Strategies:

- Partnerships with Financial Institutions:

- Bank Promotions: Partner with banks and credit unions to promote recurring FedNow autopay to their customers through special promotions.

- Joint Educational Campaigns: Collaborate with financial institutions to educate both consumers and businesses on the benefits and ease of setting up recurring FedNow autopay.

- Industry Collaboration:

- Sector-Specific Campaigns: Develop campaigns targeting specific industries (e.g., utilities, telecom, insurance) to promote recurring payments via FedNow.

- Pilot Programs: Initiate pilot programs with select businesses to showcase the effectiveness and benefits of recurring FedNow autopay.

By implementing these strategies, financial institutions and businesses can effectively promote recurring FedNow autopay, leveraging its advantages to create a seamless, efficient, and secure payment ecosystem for both consumers and businesses.

Let Your Payments Run on AutoPilot with TodayPayments.com

Why wait days to get paid when your customers are ready to authorize you now?

With FedNow® AutoPay, your business can:

- 🔄 Enable recurring billing with one-time payer approval

- ⚡ Receive irrevocable funds in real time

- 📊 Reduce aging receivables and automate reconciliation

- 💼 Scale your cash flow with C2B and B2B recurring payments

- 🔐 Eliminate the risks of ACH failures and credit card chargebacks

Set it. Forget it. Get paid instantly.

👉 Visit TodayPayments.com today and modernize your billing with FedNow® AutoPay—the future of real-time recurring payments.

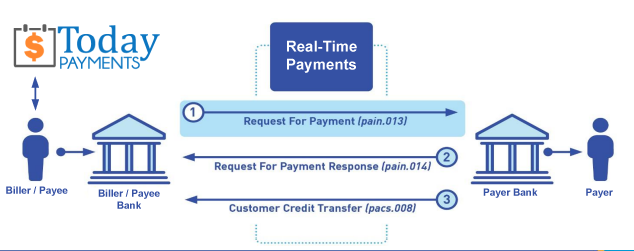

Creation Recurring Request for Payment

We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-TimePayments.com to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", either FedNow or RTP, will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

ACH and both Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions

The versions that

NACHA recommends for the Request for Payment message and the Response to the Request are pain.013 and pain.014

respectively. Version 5 for the RfP messages, which

The Clearing House Real-Time Payments system has implemented, may also be utilized as

there is no material difference in the schemas. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP ® and FedNow ® versions are Credit Push Payments.

Payees ensure the finality of Instant Real-Time

Payments (IRTP) and FedNow using recurring Requests for

Payments (RfP), Payees can implement certain measures:

1.

Confirmation Mechanism:

Implement a confirmation mechanism to ensure that each

payment request is acknowledged and confirmed by the payer

before the payment is initiated. This can include requiring

the payer to provide explicit consent or authorization for

each recurring payment.

2.

Transaction Monitoring:

Continuously monitor the status of recurring payment

requests and transactions in real-time to detect any

anomalies or discrepancies. Promptly investigate and resolve

any issues that arise to ensure the integrity and finality

of payments.

3.

Authentication and

Authorization: Implement strong

authentication and authorization measures to verify the

identity of the payer and ensure that only authorized

payments are processed. This can include multi-factor

authentication, biometric verification, or secure

tokenization techniques.

4.

Payment Reconciliation:

Regularly reconcile payment transactions to ensure that all

authorized payments have been successfully processed and

finalized. This involves comparing transaction records with

payment requests to identify any discrepancies or

unauthorized transactions.

5.

Secure Communication Channels:

Utilize secure communication channels, such as encrypted

messaging protocols or secure APIs, to transmit payment

requests and transaction data between the payee and the

payer. This helps prevent unauthorized access or

interception of sensitive payment information.

6.

Compliance with Regulatory

Standards: Ensure compliance with

relevant regulatory standards and guidelines governing

instant payments and recurring payment transactions. This

includes adhering to data security requirements, fraud

prevention measures, and consumer protection regulations.

By implementing these measures, Payees can enhance

the finality and security of Instant Real-Time Payments

using recurring Requests for Payments, thereby minimizing

the risk of payment disputes, fraud, or unauthorized

transactions.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing